Republicans have valid reasons for their reluctance to raise taxes. Here is the blog Hot Air on this point:

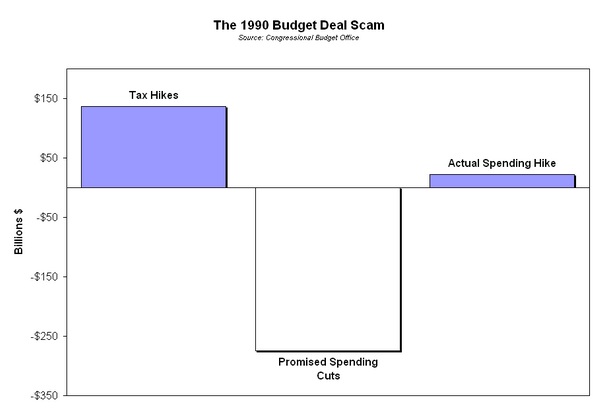

We don’t need to look too far back in American history for a primer on this tactic. A Democratic Congress convinced George H. W. Bush to raise taxes in exchange for a promise to cut spending in 1990, forcing Bush to reverse his “read my lips” pledge. Not only did the Democrats fail to deliver cuts or tax reform, they then used the “read my lips” clip in the 1992 presidential contest. Before that, Democrats in Congress convinced Ronald Reagan to sign an amnesty bill in exchange for reforms in border security and control, only to renege on that as well.

Here is the Bush I tax/spending cuts in graphic form.

Another problem is that the cuts are often not well specified, and are back-loaded into the 10 year time frame. We need cuts right now that are specific, and in the next fiscal year.

Another valid reason not to raise taxes is that Obama has already raised taxes quite a bit. From the WSJ:

For first time, the bill also applies Medicare’s 2.9% payroll tax rate to investment income, including dividends, interest income and capital gains. Added to the 0.9% payroll surcharge, that means a 3.8-percentage point tax hike on “the rich.” Oh, and these new taxes aren’t indexed for inflation, so many middle-class families will soon be considered rich and pay the surcharge as their incomes rise past $250,000 due to tax-bracket creep. Remember how the Alternative Minimum Tax was supposed to apply only to a handful of millionaires?

Obama has already raised the capital gains tax to almost 19%. Then there is the tax on health policies that is due to take effect in 2018. From the WSJ:

Starting in 2018, the bill imposes a whopping 40% "excise tax" on high-cost health insurance plans. Though it only applies to two years in the 2010-2019 window of ObamaCare's original budget score, this tax would still raise $32 billion—and much more in future years.

This will directly effect me as it will force a reduction in coverage for me and my employees. Of course no one's coverage will change.

From sources at Roll Call

“How much does the Biden plan actually cut from next year’s discretionary spending budget?” the Kentucky Republican asked the room.

Obama’s Office of Management and Budget Director Jacob Lew told him, “$2 billion.”

A second source close to the original Biden group confirmed this number.

Note that this is billion, not trillion. Fake budget cuts will only make the problem worse. Obama is not serious. Even the Republicans are only slightly more serious. The 4 trillion Ryan proposal of the Republicans is a cut of 1.8 trillion.

And of course there is the possibility that the Republicans will raise taxes now, and then President Obama in 2013 will allow the Bush tax cuts to expire, raising taxes 3.5 trillion over 10 years. While I support a tax increase, the Republicans need to be careful. The Devil is in the details.

Monday, July 18, 2011 at 6:00AM

Monday, July 18, 2011 at 6:00AM