The elephant in the room is the effect of inflation on investments. Having decided not to buy Jr. Mining stocks, what then should I buy?

The elephant in the room is the effect of inflation on investments. Having decided not to buy Jr. Mining stocks, what then should I buy?

One traditional piece of advice is to buy an index fund of various stocks so that one participates in a market upswing, while not having the risk of just one, or a few, stocks. Maybe, but the way the market works right now it is difficult for me to suggest that. Things are just too uncertain. Here is what Simon Black says about that strategy:

Most investors only think in terms of ‘nominal’ numbers, i.e. Dow 14,000+ is 40% higher than Dow 10,000 (back in November 2009). But few think in terms of ‘real’ numbers… inflation-adjusted averages.

...

Take beef, for example. Based on USDA retail price data, today the Dow will buy you 3,332 pounds of beef in the supermarket. This sounds like a lot. But it’s actually about 20% less than the 4,046 pounds of beef the Dow would buy back in December 1999.

...

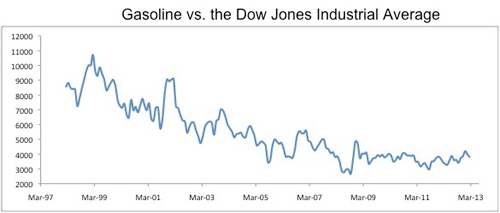

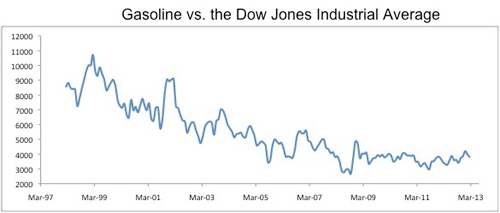

Gasoline is an even more interesting example. Today, the Dow will buy roughly 3,812 gallons of unleaded, non-premium gasoline in the United States. This is almost exactly the same as last January, just fifteen months ago, when the Dow was only 12,633.

But to match its high of 10,718 gallons set in March 1999, the Dow would need to almost triple from where it’s at today.

Simon Black may be right, but he does ignore dividends. While dividends are considerably smaller than they were a few years ago, they take away much of the comparison Simon is trying to make. It is misleading.

But in any event, I agree with Simon that now is not a good time to be buying stocks. It is just too chaotic a time for "normal" investments—remember the video I shared yesterday about market manipulation.

Here is what I recommend before you do any investments at all.

A. Do away with all credit card debt.

A. Do away with all credit card debt.

B. Have one month’s worth of household expenditures in cash in your house. (Yes I know it is a risk, it could get stolen.)

C. Have three months’ worth of family monthly expenditures in a savings account at the bank. (Yes I know it is a risk, the banks could close.)

D. Have three months’ worth of household expenditures in junk silver divided between a safe deposit box and your house. (Yes I know there is a risk that the money in the safe deposit box will not be accessible. During the Great Depression when banks were closed, customers could still get into their safe deposit boxes.)

But please no Pop Tarts! E. Gradually build up an inventory of food, in other words have a large pantry. Buy food that you normally eat. You do not need expensive survival food.

But please no Pop Tarts! E. Gradually build up an inventory of food, in other words have a large pantry. Buy food that you normally eat. You do not need expensive survival food.

After you have done these things you might consider some investments. I have not done all these things myself, but I plan to do so this year, especially building up a food inventory.

What should some of your early "investments" be? I use " " since the two next things I am going to suggest are not exactly investments.

A. Pay off your house. Or sell your house and rent. It makes no sense to me to buy bonds that yield you 1 or 2% while paying 4% or more on your house. If Peter Schiff is right and Real Estate is Grossly Overpriced, downsizing your exposure to real estate is a smart move. Do not think of your house as an investment, it is consumption that some day might be sold for a partial return of your capital.

A. Pay off your house. Or sell your house and rent. It makes no sense to me to buy bonds that yield you 1 or 2% while paying 4% or more on your house. If Peter Schiff is right and Real Estate is Grossly Overpriced, downsizing your exposure to real estate is a smart move. Do not think of your house as an investment, it is consumption that some day might be sold for a partial return of your capital.

B. Install an alternative energy system if your house is situated properly. Note that there is a substantial tax break for doing so, and the reduction in electricity costs are a tax-free reduction in household expenditures. I hope to do this in 2014.

Once you have done all these things, then it might make sense to make some investments. Most people will never be in a position to do all these things, so I guess I am saying not to invest until you do.

Note that you can do each of these things gradually in a multi-track plan. I have not done all these things myself, but hope to over the next year. If you try to do everything at once, you will become discouraged and do nothing. As clichéd as it sounds, I suggest baby steps.

Note that you can do each of these things gradually in a multi-track plan. I have not done all these things myself, but hope to over the next year. If you try to do everything at once, you will become discouraged and do nothing. As clichéd as it sounds, I suggest baby steps.

We live in interesting times. We can use the time we have until the crisis hits to get our respective financial houses in order, or we can have whatever financial house we have taken away from us.

Let me add a couple of points.

If you do pay off your house, save at least what your house payment was to replenish your savings.

Solar only works as an "investment" if you pay a substantial amount of income taxes each year. The tax credit makes it work.

I do not feel confident giving financial advice except in real estate, so remember that this is preinvestment advice!

Friday, April 12, 2013 at 3:00AM

Friday, April 12, 2013 at 3:00AM  Coming to a financial portfolio near you!Economically we have been cascading from one Bubble to another. The first two bubbles were gold and silver, where gold reached over $800 an ounce in 1980. They crashed. The next bubble is still with us. Interest rates have been dropping for almost 35 years. This bubble has not crashed yet but it will. While this bubble has been going on two other bubbles grew and popped. The Dot Com bubble popped in 2001; the Real Estate Bubble popped in 2008. The continual drop in interest rates fed these bubbles. In fact the low interest rates have been fueling a resurgent Real Estate bubble. The rates are not just low; they are not just at generational lows; they are as low as they have ever been in history.

Coming to a financial portfolio near you!Economically we have been cascading from one Bubble to another. The first two bubbles were gold and silver, where gold reached over $800 an ounce in 1980. They crashed. The next bubble is still with us. Interest rates have been dropping for almost 35 years. This bubble has not crashed yet but it will. While this bubble has been going on two other bubbles grew and popped. The Dot Com bubble popped in 2001; the Real Estate Bubble popped in 2008. The continual drop in interest rates fed these bubbles. In fact the low interest rates have been fueling a resurgent Real Estate bubble. The rates are not just low; they are not just at generational lows; they are as low as they have ever been in history. Economics,

Economics,  Investment

Investment