The Future Is Difficult To Predict Because It Has Not Happened Yet

Monday, August 8, 2011 at 6:00AM

Monday, August 8, 2011 at 6:00AM  Usually those that have the kind of views I have think that we will have hyperinflation. I have never felt that way. I think the most likely outcome is moderate inflation in the 10 to 20% range for a few years. Hyperinflation would be so counterproductive that its occurrence seems unlikely.

Usually those that have the kind of views I have think that we will have hyperinflation. I have never felt that way. I think the most likely outcome is moderate inflation in the 10 to 20% range for a few years. Hyperinflation would be so counterproductive that its occurrence seems unlikely.

But as Yogi Berra said, “The future is difficult to predict because it has not happened yet.” What will the government do if current trends continue? At some point the government will be unable to borrow money. Then one of two things will happen. Either the government will default or just print the money to pay off its debt. As bad as default would be it would be preferable to hyperinflation.

I doubt that the government would be stupid enough to let things get that bad. I still think we will have a series of bills/reforms over the next few years that will gradually reduce the deficit. So among the hard money crowd I am what passes for an optimist.

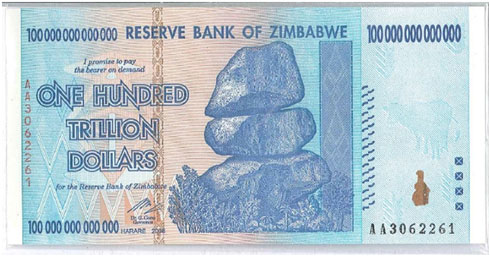

Our Future?

Our Future?

Chris Mack has an interesting article at www.resourceinvestor.com. I recommend the article. Chris says this:

According to a study of 775 fiat currencies by DollarDaze.org, there is no historical precedence for a fiat currency that has succeeded in holding its value. Twenty percent failed through hyperinflation, 21% were destroyed by war, 12% destroyed by independence, 24% were monetarily reformed, and 23% are still in circulation approaching one of the other outcomes.

Eventually all fiat money systems fail. We have a fiat money system. Here is Wikipedia’s definition:

Fiat money is money that has value only because of government regulation or law.

The term derives from the Latin fiat, meaning “let it be done,” as such money is established by government decree. Where fiat money is used as currency, the term fiat currency is used. Fiat money originated in 11th century China, and its use became widespread during the Yuan and Ming dynasties.

The Nixon Shock of 1971 ended the direct convertibility of the United States dollar to gold. Since then all reserve currencies have been fiat currencies, including the dollar and the euro.

But often the failure is gradual over a long period of time. The most successful fiat currency is the British pound. Here is what Chris said about the pound.

The average life expectancy for a fiat currency is 27 years, with the shortest life span being one month. Founded in 1694, the British pound Sterling is the oldest fiat currency in existence. At a ripe old age of 317 years it must be considered a highly successful fiat currency. However, success is relative. The British pound was defined as 12 ounces of silver, so it’s worth less than 1/200 or 0.5% of its original value. In other words, the most successful long standing currency in existence has lost 99.5% of its value.

How well has the dollar done since Nixon took the US off a partial gold standard in 1971? Chris continues:

The US dollar was taken off of the gold standard in 1971 when it was 1/35th an ounce of gold. At 40 years old, it has already lost 97% of its value. Yet it has lasted longer than the average fiat currency so perhaps its performance should be labeled “better than expected.” The US dollar has fallen by an average 9% annually over this 40 year period when measured against gold. As such, investment advisers may want to readjust their inflation expectations when projecting dollar based investments. The S&P 500 appreciated at 7% over the same 40 year period – not even keeping pace with the decline in purchasing power of the dollar.

I agree with Chris in that I think gold is going up. But I also disagree with him because I think that gradually we will cut the deficit. But while we do so there will be economic troubles. This is because such a huge spending cut/tax increase will have a very negative effect on the economy. The only thing worse that these spending cuts and tax increases is doing nothing—which seems to be the bi-partisan approach to our crisis. But as the crisis continues the changes will be forced on the government. I predict the death of 1000 cuts.

I agree with Chris in that I think gold is going up. But I also disagree with him because I think that gradually we will cut the deficit. But while we do so there will be economic troubles. This is because such a huge spending cut/tax increase will have a very negative effect on the economy. The only thing worse that these spending cuts and tax increases is doing nothing—which seems to be the bi-partisan approach to our crisis. But as the crisis continues the changes will be forced on the government. I predict the death of 1000 cuts.

Reader Comments (1)

HOWEVER...

If I was a Calvinist...

AND , if I believed in multi dimensional universes, complete with wormholes and "space time continuums" , I could argue that indeed that the "Future has already happened" , or that tomorrow is yesterday!

Maybe Joan Collins didn't have to die in that Star Trek episode after all and everyone could have eaten that "time travel portal thing" like a donut with some Starbucks coffee!

Eddie H. Nessul

Amboy , California

(Read Names Backwards)