To Infinity and Beyond

Monday, September 17, 2012 at 5:01AM

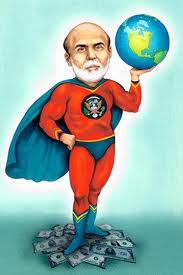

Monday, September 17, 2012 at 5:01AM  Toy Story was recently declared to be the second best animated film ever made. (Who decides these things? It is clearly number one.) The catch-phrase of Buzz Lightyear has entered our collective conscience—“to Infinity and Beyond.” This catch-phrase is starting to make the rounds in the usual places with regard to Ben “Buzz” Bernanke, who has just announced QEIII.

Toy Story was recently declared to be the second best animated film ever made. (Who decides these things? It is clearly number one.) The catch-phrase of Buzz Lightyear has entered our collective conscience—“to Infinity and Beyond.” This catch-phrase is starting to make the rounds in the usual places with regard to Ben “Buzz” Bernanke, who has just announced QEIII.

What is QE? It is an abbreviation for Quantitative Easing. Wikipedia describes QE this way.

Quantitative easing (QE) is an unconventional monetary policy used by central banks to stimulate the national economy when conventional monetary policy has become ineffective. A central bank implements quantitative easing by buying financial assets from commercial banks and other private institutions with newly created money, in order to inject a pre-determined quantity of money into the economy. This is distinguished from the more usual policy of buying or selling government bonds to keep market interest rates at a specified target value. Quantitative easing increases the excess reserves of the banks, and raises the prices of the financial assets bought, which lowers their yield.

Financial Times of London describes the current round of Quanitative Easing this way:

It was not so much QE3 as QE∞. [The symbol ∞ is the “infinity sign” in math.]

Why is this a big deal? Compared to the two previous QEs (it stands for “quantitative easing” and refers to a central bank buying bonds to push down their yields), this one is unlimited. While the previous two were for fixed amounts, this time the Fed will keep buying $40bn of mortgage-backed securities until the labour market has improved “substantially”. That word is to be interpreted by the Fed, allowing it to carry on for as long as it likes.

Romney and Ryan need to be in this picture too. Buying 40 billion dollars of mortgages every year, er ... no, that should be month… will please Paul Krugman, but no one else. Gold took an immediate spike upward in price. I wish I owned more. While I have been in favor of QE, I wanted it to be a part of a package that included tax increases and budget cuts. Such a package is not even being talked about as a possibility.

Romney and Ryan need to be in this picture too. Buying 40 billion dollars of mortgages every year, er ... no, that should be month… will please Paul Krugman, but no one else. Gold took an immediate spike upward in price. I wish I owned more. While I have been in favor of QE, I wanted it to be a part of a package that included tax increases and budget cuts. Such a package is not even being talked about as a possibility.

Buying mortgages is also the very worst place that the Fed could buy securities. Interest rates are low enough already in that area. Driving them lower will only distort the market even more and encourage more debt. This we do not need.

We Americans, as a people, already put way too much of our assets into houses. Why not enjoy it now, and then sell it later for retirement? Unfortunately, the homeowner has run out of bigger fools to sell to. This constant pressure will be with us permanently. Note that since my profession over the last few decades involves buying and selling houses and residential land, and supplying contractors with hardware and lumber, I may need to adjust my personal business plan a mite. (I will talk more about housing tomorrow.)

Having sold my 4,000 sq. ft. house and moving into a 2,000 sq. ft. has shown me that my family does not need all that space. My daughter is a little shy on space, but we can move her into the office when she is older if we need to. Or maybe, just maybe, she can learn to cope with one closet. As long as I have room for my toys we will be fine. Actually, I got rid of most of my toys—my books—in the move. I brought ten boxes of books to California. I have ten boxes of books still in storage for a later trip. Those who have seen my former library will instantly realize what a huge reduction in books this is. I counted my books many years ago. I had 1400+ at the time. It has been actually somewhat traumatic for me to pare the collection down. This is not a joke. Well, maybe a little one.

Having sold my 4,000 sq. ft. house and moving into a 2,000 sq. ft. has shown me that my family does not need all that space. My daughter is a little shy on space, but we can move her into the office when she is older if we need to. Or maybe, just maybe, she can learn to cope with one closet. As long as I have room for my toys we will be fine. Actually, I got rid of most of my toys—my books—in the move. I brought ten boxes of books to California. I have ten boxes of books still in storage for a later trip. Those who have seen my former library will instantly realize what a huge reduction in books this is. I counted my books many years ago. I had 1400+ at the time. It has been actually somewhat traumatic for me to pare the collection down. This is not a joke. Well, maybe a little one.

This chart will show you what I mean. It shows the size of the average house by country by sq. meters. To get the more expected “English” measurements multiple by 10.76. So the average house in Britain is roughly 880 sq. feet as compared to 2300 in the United States.

Typical Russian Apartment BlockWhile I was not able to find the figures for house size in Russia, it has to be smaller than Britain. In Russia each room has to serve multiple functions. When we go to Russia to visit family, the dining room becomes my computer room and a bedroom. The living room becomes a bedroom at night. The convertible beds are actually much more comfortable than the hide-a-beds we use in America—they have to be as they are used every night. Yes, there is a little work to prepare the bed at night, and a little work to make it a living room again in the morning, but this is minor. While my mother-in-law's kitchen is as small as the average American walk-in closet, it is adequate and we even eat there. The main issue is the lack of closet space, but if you are like me, you have enough clothes to last for years. I might need to buy socks, but that is about it.

Typical Russian Apartment BlockWhile I was not able to find the figures for house size in Russia, it has to be smaller than Britain. In Russia each room has to serve multiple functions. When we go to Russia to visit family, the dining room becomes my computer room and a bedroom. The living room becomes a bedroom at night. The convertible beds are actually much more comfortable than the hide-a-beds we use in America—they have to be as they are used every night. Yes, there is a little work to prepare the bed at night, and a little work to make it a living room again in the morning, but this is minor. While my mother-in-law's kitchen is as small as the average American walk-in closet, it is adequate and we even eat there. The main issue is the lack of closet space, but if you are like me, you have enough clothes to last for years. I might need to buy socks, but that is about it.

If you want some comparisons between life in Russia and America, click here.

Why am I going on and on about Russian housing? To make a point that you can downsize and not affect your lifestyle very much. Would you rather have a 2500 sq. ft. house that you lose to the bank, or a 1500 sq. ft. house you can keep? Those kinds of times are coming as a permanent reality to all of us. Be prepared.

Why am I going on and on about Russian housing? To make a point that you can downsize and not affect your lifestyle very much. Would you rather have a 2500 sq. ft. house that you lose to the bank, or a 1500 sq. ft. house you can keep? Those kinds of times are coming as a permanent reality to all of us. Be prepared.

Ben “Buzz” Bernanke thinks that he is some sort of superhero. When Buzz Lightyear thought this he got into trouble. Ben is no different. He is just a toy of the banksters. The “powers that be" think they can kick the can down the road with QE, but the fact that this QE episode has no terminus should tell us that they do not expect a recovery any time soon. I fear it is permanent, so be prepared.

Economics,

Economics,  Real Estate,

Real Estate,  Russia

Russia

Reader Comments