Money is Fungible

Wednesday, January 16, 2013 at 3:00AM

Wednesday, January 16, 2013 at 3:00AM  Maybe I am wrong in the way I look at economics. But one of the founding principles I use is that money is fungible. I learned this word myself not that long ago listening to a sermon where the preacher said that time is fungible. The point of the sermon was to use your time wisely. Here is how Wikipedia defines fungible:

Maybe I am wrong in the way I look at economics. But one of the founding principles I use is that money is fungible. I learned this word myself not that long ago listening to a sermon where the preacher said that time is fungible. The point of the sermon was to use your time wisely. Here is how Wikipedia defines fungible:

Fungibility is the property of a good or a commodity whose individual units are capable of mutual substitution, such as crude oil, shares in a company, bonds, precious metals, or currencies.

It refers only to the equivalence of each unit of a commodity with other units of the same commodity. Fungibility does not describe or relate to any exchange of one commodity for some other, different commodity.

As an example: if Alice lends Bob a $10 bill, she does not care if she is repaid with the same $10 bill, two $5 bills, a $5 bill and five $1 bills, or bunch of coins that total $10, as currency is fungible. However, if Bob borrows Alice’s car she will most likely be upset if Bob returns a different vehicle—even a vehicle that is the same make and model—as automobiles are not fungible with respect to ownership. However, gasoline is fungible, and though Alice may have a preference for a particular brand and grade of gasoline, her primary concern may be that the level of fuel be the same (or more) as it was when she lent the vehicle to Bob.

A dollar spent on one item cannot be spent on another item. If a person is taxed one dollar, that dollar is no longer spent by the taxpayer. The government spending that dollar does not increase societal wealth. It is at best neutral. We see the money the government spends, but we do not see the money that the taxpayer would have spent. There are exceptions to this. The bridge that is constructed over the Mississippi may result in greater societal benefit than the cost of the bridge. However, when the government does it we often do not build the bridge based on economics, but on the fact that contributor John Smith owns the property next to the bridge. Sometimes you even get the absurdity of the infamous “bridge to nowhere.” In other words the return of the government spending is less than the one dollar of taxes.

So from my perspective every dollar that is spent by the government that is borrowed or taxed does not offer a stimulus. We see the government spending, but we do not see what the dollar would have been spent on had it not been borrowed or taxed. Basically I am saying that spending on defense or spending on social programs do not help the economy, they are, hopefully neutral. This does not mean that we should not buy the new F-22 Raptor, although we could buy 10 of the old fighter for what one F-22 costs.

So from my perspective every dollar that is spent by the government that is borrowed or taxed does not offer a stimulus. We see the government spending, but we do not see what the dollar would have been spent on had it not been borrowed or taxed. Basically I am saying that spending on defense or spending on social programs do not help the economy, they are, hopefully neutral. This does not mean that we should not buy the new F-22 Raptor, although we could buy 10 of the old fighter for what one F-22 costs.

Nor does it mean that we should not help the poor. I am only saying that there is no free lunch and that this spending will NOT benefit the economy. What the government does is reallocate resources—mostly badly in my view.

There is a big exception to what I am saying and that is money printing. Right now the Federal Reserve is spending about one trillion a year buying mortgages and treasury bonds. This is entirely new money and will stimulate the economy, temporarily. If the amount of the fiscal deficit goes down by some method, I would do a budget freeze, as long as the Federal Reserve continues its current practice the stimulus would  continue at the present level, even as the budget deficit goes down.

continue at the present level, even as the budget deficit goes down.

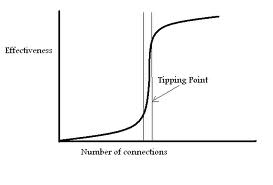

The main risk I see is that the amount of the debt will reach a tipping point and chaos will ensue. If investors knew that the budget crisis was resolved they would have little concern with governmental bonds. If investors think the problem will NOT be solved, then the crisis will come, and it will not be pretty.

Better to freeze the budget now, rather than have it implode later.

Economics

Economics

Reader Comments