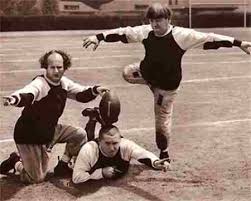

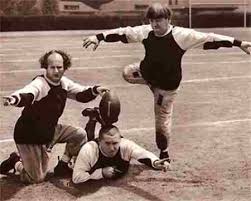

3 Funny Men

Sunday, June 9, 2013 at 3:00AM

Sunday, June 9, 2013 at 3:00AM That was what my wife called these gentlemen when she first came to the US. Yes there are some women who like them.

Humor

Humor

"One should either write ruthlessly what one believes to be the truth, or else shut up."

Arthur Koestler

Sunday, June 9, 2013 at 3:00AM

Sunday, June 9, 2013 at 3:00AM That was what my wife called these gentlemen when she first came to the US. Yes there are some women who like them.

Humor

Humor  Saturday, June 8, 2013 at 3:00AM

Saturday, June 8, 2013 at 3:00AM I was at my local coffee shop complaining internally about coffee costing $4 when I heard a customer talk about Star Trek's most recent incarnation. "It's Die Hard in Space," he said. He is right.

No matter how many times the Enterprise is destroyed, it is always ready for a sequel! Do not worry about spoilers as this is not really a review, but more a commentary on modern movies and television. Modern video is "extreme unlikelihood" combined with "total predictability."

No matter how many times the Enterprise is destroyed, it is always ready for a sequel! Do not worry about spoilers as this is not really a review, but more a commentary on modern movies and television. Modern video is "extreme unlikelihood" combined with "total predictability."

Any Jackie Chan movie is a good example of what I mean. He does all these amazing stunts. To his credit he does them himself, but they are still stunts. Look at the blooper reels for his movies. While each of these stunts is "doable," the chance if anyone being able to string these stunts together is zero. Even Jackie must do these stunts many times to get it right. I suppose I am to "suspend disbelief." I suppose.

An example of predictability is an episode of Monk where right at the beginning, I think before the murder even happened, I said who did it and why. My son is still amazed by this. It is not that I am so good, but that modern video is so bad.

An example of predictability is an episode of Monk where right at the beginning, I think before the murder even happened, I said who did it and why. My son is still amazed by this. It is not that I am so good, but that modern video is so bad.

So if you want unlikely stunts combined with extreme predictability be sure to go to a theatre near you ... or wait for Netflix like I wished I had done.

Review

Review  Friday, June 7, 2013 at 9:00AM

Friday, June 7, 2013 at 9:00AM  Even Mickey is Toast! The general assumption is that China is doing fine, thank you very much. I have a friend that is spending more and more time in China. I was totally unable to convince him that China has issues. As an attorney, my guess is that he will do well no matter what.

Even Mickey is Toast! The general assumption is that China is doing fine, thank you very much. I have a friend that is spending more and more time in China. I was totally unable to convince him that China has issues. As an attorney, my guess is that he will do well no matter what.

But for the average resident, how bad is China?

Latest research figures carried out by the Bank of America Corp. are set to rock the economies around the world once again. Has China been hiding the real state of its economic data? It would seem that the PRC hasn’t been quite as honest as it might have us all believe! According to the Bank of America Corp., the Chinese trade surplus that was meant to stand at some $61 billion turns out to be a meager mere tenth of that so far this year.

Another problem is that Chinese investors have this odd idea that empty apartments are a good investment.

A recent CBS 60 Minutes report in the US exposed dozens of new cities in China sitting empty—with the apartments snapped up as investments by the nation's wealthy middle class, then sitting empty as the owners fail to find tenants who can meet the rent.

A recent CBS 60 Minutes report in the US exposed dozens of new cities in China sitting empty—with the apartments snapped up as investments by the nation's wealthy middle class, then sitting empty as the owners fail to find tenants who can meet the rent.

Financial experts fear the ghost town explosion will lead to a housing bubble burst, following China's real estate boom which came after the government changed its policy 15 years ago and allowed people to buy their homes.

The middle class saw real estate as a solid investment, more stable than the share market and offering better returns than the banks.

This is just plain crazy. I know from first-hand experience that empty real estate is a depreciating asset. This will not end well.

I have been talking about various kinds of toast. Japan is toast. Europe is toast. Now China has joined that august breakfast of champions, they are toast as well. Is the US toast? That I will address very soon.

Economics

Economics  Saturday, June 1, 2013 at 3:00AM

Saturday, June 1, 2013 at 3:00AM  I remember this song. I also remember the critiques of this song that insisted most of the examples in the lyrics are not ironic.

I remember this song. I also remember the critiques of this song that insisted most of the examples in the lyrics are not ironic.

But isn't it ironic that the current speculation about the Federal Reserve stopping or reducing Quantitative Easing (or as we hard money types call it, money printing) is causing distress, rejoicing, fear, and loathing in Washington. I guess my own perspective is a combination of rejoicing and fear.