Scary Alan

Thursday, August 11, 2011 at 6:00AM

Thursday, August 11, 2011 at 6:00AM Alan Greenspan said this on Meet the Press:

The United States can pay any debt it has because we can always print money to do that. So there is zero probability of default.

Statements like this are why many fear we are headed toward hyperinflation. But how can one predict with certainty what someone will do in a crisis. I think that debt repudiation is far more likely than hyperinflation. Greenspan is no longer Federal reserve Chairman. What does our current Federal reserve chairman think?

People know that inflation erodes the real value of the government's debt and, therefore, that it is in the interest of the government to create some inflation.

Ben Bernanke also proposed that if all else fails the Federal Reserve could drop money from helicopters. To be fair to Bernanke he was quoting Milton Friedman. However the inflation argument does seem rather strong. Why then do I think it will not happen?

I Am Praying TooI may be an optimist, but hyperinflation would destroy the investments of much of the elite that run our country. Their own self-interest should keep it from happening. The bond market is signaling a continuation of the recession by the lowering of interest rates, even on the recently downgraded treasury bonds. The current stock market prices are signaling a continuation of economic growth by its price to earnings multiple. While it is possible that both are right—that we are headed toward economic collapse with higher corporate profits, this seems unlikely. I smell the plunge protection team.

I Am Praying TooI may be an optimist, but hyperinflation would destroy the investments of much of the elite that run our country. Their own self-interest should keep it from happening. The bond market is signaling a continuation of the recession by the lowering of interest rates, even on the recently downgraded treasury bonds. The current stock market prices are signaling a continuation of economic growth by its price to earnings multiple. While it is possible that both are right—that we are headed toward economic collapse with higher corporate profits, this seems unlikely. I smell the plunge protection team.

Church of the Annuciation, Murom, RussiaThe only good news is the drop in oil prices, which of course is bad news for Russia where I am headed next week. I will probably look for apartments while I am there, you never know. The ruble hit new lows today, almost as low as it was in 2002 when I first went to Russia. We will visit the oldest wooden church in the world. I will study Russian. We will drink vodka. I enjoy visiting my mother-in-law. She is the perfect mother-in-law. She does not speak English.

Church of the Annuciation, Murom, RussiaThe only good news is the drop in oil prices, which of course is bad news for Russia where I am headed next week. I will probably look for apartments while I am there, you never know. The ruble hit new lows today, almost as low as it was in 2002 when I first went to Russia. We will visit the oldest wooden church in the world. I will study Russian. We will drink vodka. I enjoy visiting my mother-in-law. She is the perfect mother-in-law. She does not speak English.

Economics

Economics Multiculturalism in Britain

Wednesday, August 10, 2011 at 6:00AM

Wednesday, August 10, 2011 at 6:00AM  There are widespread riots in London. This is not a good sign that my view that social disorder will not be major is correct. Decades ago in the English Parliament, Enoch Powell talked about the lack of assimilation of many British citizens. Since the citizens he spoke of were black, he was accused of being racist.

There are widespread riots in London. This is not a good sign that my view that social disorder will not be major is correct. Decades ago in the English Parliament, Enoch Powell talked about the lack of assimilation of many British citizens. Since the citizens he spoke of were black, he was accused of being racist.

Christian Odone, a blogger for the Telegraph, had this to say:

Broadcasters and talking heads want a narrative that props up liberal myths. They want to talk of the spirit of community that has been broken by hard economic times. They want to shoe-horn the people of Tottenham into the heroic mould of London’s East Enders who stood shoulder to shoulder during the Blitz: this, they think, will prove to the public that we are right about the cruelty of the Coalition’s cuts. But listen to eyewitnesses in Tottenham and Enfield and they are telling a different story. It is one that stars criminals, not “community.

The riots are well spread throughout London. Click on the Google map link here to see how widespread they are.

No doubt the British government is taking the needed steps to assure the peace? Well, no, they are not:

The Home Secretary appeared to rule out sending water cannon or the Army onto the streets of the capital, despite a third night of violence. Speaking on Sky News, she said that police intelligence and the support of local communities would help quell the disturbances. “The way we police in Britain is not through use of water cannon,” she said. “The way we police in Britain is through consent of communities.”

I doubt that criminals will give their consent to be arrested. This is about wide-screen "tellies," not poverty. As Lord Melbourne said, "The whole duty of government is to prevent crime and to preserve contracts.” Britain is failing that duty. Hopefully this will not spread.

The Future Is Difficult To Predict Because It Has Not Happened Yet

Monday, August 8, 2011 at 6:00AM

Monday, August 8, 2011 at 6:00AM  Usually those that have the kind of views I have think that we will have hyperinflation. I have never felt that way. I think the most likely outcome is moderate inflation in the 10 to 20% range for a few years. Hyperinflation would be so counterproductive that its occurrence seems unlikely.

Usually those that have the kind of views I have think that we will have hyperinflation. I have never felt that way. I think the most likely outcome is moderate inflation in the 10 to 20% range for a few years. Hyperinflation would be so counterproductive that its occurrence seems unlikely.

But as Yogi Berra said, “The future is difficult to predict because it has not happened yet.” What will the government do if current trends continue? At some point the government will be unable to borrow money. Then one of two things will happen. Either the government will default or just print the money to pay off its debt. As bad as default would be it would be preferable to hyperinflation.

I doubt that the government would be stupid enough to let things get that bad. I still think we will have a series of bills/reforms over the next few years that will gradually reduce the deficit. So among the hard money crowd I am what passes for an optimist.

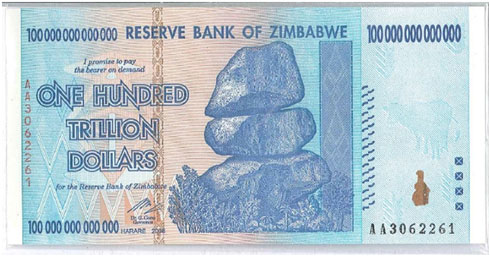

Our Future?

Our Future?

Chris Mack has an interesting article at www.resourceinvestor.com. I recommend the article. Chris says this:

According to a study of 775 fiat currencies by DollarDaze.org, there is no historical precedence for a fiat currency that has succeeded in holding its value. Twenty percent failed through hyperinflation, 21% were destroyed by war, 12% destroyed by independence, 24% were monetarily reformed, and 23% are still in circulation approaching one of the other outcomes.

Eventually all fiat money systems fail. We have a fiat money system. Here is Wikipedia’s definition:

Fiat money is money that has value only because of government regulation or law.

The term derives from the Latin fiat, meaning “let it be done,” as such money is established by government decree. Where fiat money is used as currency, the term fiat currency is used. Fiat money originated in 11th century China, and its use became widespread during the Yuan and Ming dynasties.

The Nixon Shock of 1971 ended the direct convertibility of the United States dollar to gold. Since then all reserve currencies have been fiat currencies, including the dollar and the euro.

But often the failure is gradual over a long period of time. The most successful fiat currency is the British pound. Here is what Chris said about the pound.

The average life expectancy for a fiat currency is 27 years, with the shortest life span being one month. Founded in 1694, the British pound Sterling is the oldest fiat currency in existence. At a ripe old age of 317 years it must be considered a highly successful fiat currency. However, success is relative. The British pound was defined as 12 ounces of silver, so it’s worth less than 1/200 or 0.5% of its original value. In other words, the most successful long standing currency in existence has lost 99.5% of its value.

How well has the dollar done since Nixon took the US off a partial gold standard in 1971? Chris continues:

The US dollar was taken off of the gold standard in 1971 when it was 1/35th an ounce of gold. At 40 years old, it has already lost 97% of its value. Yet it has lasted longer than the average fiat currency so perhaps its performance should be labeled “better than expected.” The US dollar has fallen by an average 9% annually over this 40 year period when measured against gold. As such, investment advisers may want to readjust their inflation expectations when projecting dollar based investments. The S&P 500 appreciated at 7% over the same 40 year period – not even keeping pace with the decline in purchasing power of the dollar.

I agree with Chris in that I think gold is going up. But I also disagree with him because I think that gradually we will cut the deficit. But while we do so there will be economic troubles. This is because such a huge spending cut/tax increase will have a very negative effect on the economy. The only thing worse that these spending cuts and tax increases is doing nothing—which seems to be the bi-partisan approach to our crisis. But as the crisis continues the changes will be forced on the government. I predict the death of 1000 cuts.

I agree with Chris in that I think gold is going up. But I also disagree with him because I think that gradually we will cut the deficit. But while we do so there will be economic troubles. This is because such a huge spending cut/tax increase will have a very negative effect on the economy. The only thing worse that these spending cuts and tax increases is doing nothing—which seems to be the bi-partisan approach to our crisis. But as the crisis continues the changes will be forced on the government. I predict the death of 1000 cuts.